The end of human productivity: A thought experiment

THOUGHT OF THE DAY – The AI Transition For Accountants (2025-2045)

First, I want to stress this is a thought experiment, not a true story or forecast, and my goal is not to realize this future, but rather to prepare for a positive outcome when faced with overwhelming change… I am using the Accounting field in this experiment as placeholder for all careers as eventually we will be having this conversation in every field.

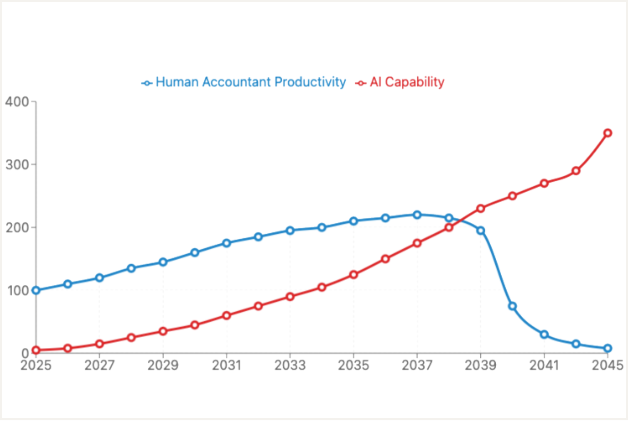

The premise: As AI expands, it is reasonable to assume that humans will see a rapid increase in their productivity right up until the point they are no longer needed in their job due to AI mastery of that activity (assuming accuracy and cost effectiveness continue to scale). The thought experiment begins at that point. What happens when this occurs?

Disclaimer: I recognize there are more likely skill replacement than job replacement on the whole and I’m assuming this will occur in some fields faster than others and perhaps not at all in other fields but for the experiment let’s assume this happens. I also realize most roles evolve over time rather than actually being wiped out but the speed of AI evolution may make this unreasonable which is the crux of this thought experiment. This speed of evolution is one of the main difference between this industrial revolution and past ones.

One other consideration driving this thought experiment is that once an AI achieves a superior solution we can have a million of them running with the same level of competence. So when an AI is better than the best accountant at doing their job, we can create a million more just like it, possibly instantly… Then what?

So assuming this scenario and as AI moves from assistant to independent operator to superior competitor, then what? So, it is unlikely we will run all the way to the end of this process in every field at the same time so people will transition and new fields will be created, it’s already happening but for the sake of argument… then what?

Conditions for the experiment

In this thought experiment we set the following conditions:

The accounting profession stands at the precipice of unprecedented transformation, following a trajectory that begins with AI enhancing human capabilities before ultimately assuming autonomous control of traditional accounting functions. This potential timeline maps the technological advancements, regulatory changes, and resulting productivity shifts that characterize this remarkable transition.

Initial Augmentation: Enhancing Human Capabilities (2025-2032)

During the initial augmentation phase, AI technologies serve primarily as productivity multipliers, enabling human accountants to accomplish more work with greater accuracy and efficiency. This is similar to the advent of the spreadsheet or tax software. At each point in time it was expected that there would be impact to the field. Well, there was impact, even more need for accountants. As software made accounting more productive, the demand for more strategic and analytical roles and more specialized services, and a broader client base skyrocketed. However their special skills and experience made them more valuable as knowledge workers who became adept at using the new tools.

2025-2027: Foundation of Enhanced Productivity

The journey begins with basic task automation and intelligence assistance that elevates human accountant productivity. By the end of 2025, human accountants integrate increasingly sophisticated AI tools into their workflows, with productivity rising approximately 5-15% annually.

Basic Automation Implementation

- Automated data entry and extraction from invoices, receipts, and statements

- Intelligent document processing systems that recognize, categorize, and digitize financial documents

- Rule-based reconciliation systems for routine transactions

- Semi-automated bookkeeping processes requiring human verification

Early AI Assistance

- Pattern recognition for anomaly detection in financial data

- Predictive categorization of expenses and transactions

- Natural language processing for extracting relevant information from contracts and financial documents

Technological Enablers

- Machine learning models trained on standardized accounting data

- Computer vision systems for document processing

- Initial integration of accounting systems with banking and financial platforms

2028-2030: Advanced Collaborative Systems

By 2030, human productivity reaches approximately 160% of 2025 baseline as AI systems handle increasingly complex accounting functions while remaining under human direction. This period sees substantive gains as accountants leverage AI tools to expand their capabilities.

Enhanced Financial Analysis

- AI-powered financial modeling and scenario planning

- Automated trend analysis across multiple reporting periods

- Risk assessment algorithms identifying potential compliance issues

- Tax optimization systems that identify advantageous filing strategies

Process Improvement

- End-to-end automation of accounts payable and receivable processes

- Intelligent cash flow forecasting and management

- Automated monthly financial close processes reducing closing time by 50-70%

- Complex transaction matching requiring minimal human intervention

Technological Enablers

- Neural networks capable of handling unstructured financial data

- Deep learning systems trained on industry-specific accounting scenarios

- Natural language generation for automated financial reporting

- Advanced API integrations across financial ecosystems

2031-2032: Peak Human-AI Synergy

Human productivity continues climbing, reaching approximately 185-195% of 2025 baseline. During this period, accountants effectively leverage AI to perform complex analytical work while focusing their attention on higher-value activities.

Strategic Financial Advisory

- AI-assisted strategic planning and financial decision support

- Automated benchmarking against industry standards and competitors

- Sophisticated valuation models incorporating multiple data sources

- Predictive analytics for business performance optimization

Advanced Compliance Management

- Continuous compliance monitoring across multiple jurisdictions

- Automated updates to accounting practices based on regulatory changes

- Intelligent detection of potential fraud patterns

- Comprehensive audit preparation with minimal human intervention

Technological Enablers

- Large language models fine-tuned for financial analysis and reporting

- Generative AI creating comprehensive financial narratives and explanations

- Federated learning systems sharing insights while maintaining data privacy

- Enhanced predictive algorithms for financial forecasting

The Inflection Point: From Augmentation to Replacement (2033-2039)

This critical transition period marks the shift from AI primarily augmenting human accountants to increasingly replacing human functions altogether. Human productivity reaches its peak before beginning its decline.

2033-2035: Early Signs of Displacement

The inflection point occurs around 2033 when AI systems begin performing complete accounting functions with minimal oversight. Human productivity peaks around 200-210% of 2025 baseline before starting its decline.

Autonomous Accounting Functions

- Fully automated tax preparation and filing for businesses of all sizes

- End-to-end audit execution with human review only for exceptions

- Comprehensive financial statement preparation with minimal human input

- Automated regulatory filing and compliance management

Beginning of Role Transformation

- Shift from task execution to AI system supervision

- Focus on exception handling rather than routine processing

- Emerging specialization in AI-accounting system management

- Growth in advisory services leveraging AI-generated insights

Technological Enablers

- Multi-agent AI systems handling complex accounting workflows

- Causal inference capabilities for financial decision-making

- Robust exception handling for unusual accounting scenarios

- Industry-standard frameworks for AI accounting system validation

2036-2039: Regulatory Adaptation and Approval

This critical period sees regulatory frameworks evolve to accommodate autonomous AI accounting systems. By 2038, sufficient regulatory approval exists for AI systems to operate with limited human supervision in many accounting domains.

Regulatory Milestones

- Initial regulatory frameworks for AI-driven accounting

- Development of standardized validation protocols for accounting AI systems

- Creation of liability and accountability models for automated financial reporting

- Establishment of certification standards for autonomous accounting systems

Organizational Adoption

- Large accounting firms implement supervised AI systems for client services

- Corporate accounting departments reorganize around AI systems

- New business models emerge for AI-centric accounting services

- Development of transition frameworks from human-led to AI-led accounting

Technological Enablers

- Explainable AI systems that provide audit trails for decisions

- Formal verification methods for accounting algorithms

- Integration with legal and regulatory compliance systems

- Advanced security and privacy protections for financial data

The Displacement Phase: AI Autonomy Reaches Maturity (2040-2045)

Following regulatory approval and technological maturity, autonomous AI accounting systems rapidly displace human accountants across the industry, with human productivity falling to just 8% of its 2025 baseline by 2045. The precipitous drop in human accounting productivity occurs between 2040-2041 when productivity plummets from 195% to approximately 30% of 2025 baseline within a single year.

Complete System Autonomy

- Fully autonomous accounting systems handling all standard functions

- Self-optimizing financial management systems

- AI-driven enterprise resource planning integration

- Real-time financial reporting and analysis without human intervention

Causes of Rapid Displacement

- Full regulatory approval for autonomous operation across accounting functions

- Dramatic cost advantages of AI systems over human accountants

- Competitive pressure forcing industry-wide adoption

- Network effects as financial systems integrate with AI accounting platforms

Technological Enablers

- Advanced general reasoning capabilities applied to accounting

- Self-improving systems that continuously optimize accounting processes

- Comprehensive knowledge repositories covering all accounting standards

- Integration with automated legal and regulatory systems

2042-2045: Redefined Accounting Profession

By 2045, AI systems operate at 350% of 2025 human productivity baseline, while human participation falls to just 8% of the original workforce, fundamentally transforming the profession.

AI Capability Expansion

- Strategic financial planning and complex decision support

- Predictive analytics identifying business opportunities

- Cross-functional integration with operations, sales, and management

- Adaptive accounting systems that evolve with business needs

Remaining Human Functions

- Specialized oversight and governance of AI accounting systems

- Exception handling for unprecedented scenarios

- Relationship management with key stakeholders

- Development and validation of new accounting AI capabilities

Technological Enablers

- AGI-adjacent systems with broad reasoning capabilities

- Meta-learning systems that adapt to new accounting challenges

- Integration with broader business intelligence ecosystems

- Self-auditing systems with comprehensive error detection

Specialized Human Roles in the New Accounting Ecosystem

As traditional accounting positions disappear, new specialized roles emerge at the intersection of finance, technology, and oversight.

Emerging Specialized Positions

- AI-Accounting Systems Specialists (2028 onwards)

- Financial Algorithm Auditors (2031 onwards)

- Accounting Ethics Technologists (2034 onwards)

- Human-AI Financial Interface Managers (2038 onwards)

- Meta-Accounting Strategists (2043 onwards)

But this can’t happen… Can it?

There is an argument that this type of transformation can’t happen. It can be argued AI may end up limited by learning caps, compute limits, energy issues, regulations may form to prevent it due to safety and other concerns, it may turn out the current limits are not surpassable. Its possible. But consider that I barely scratched the surface of the breakthroughs that could happen that could make this thought experiment not nearly ambitious enough to capture the potential. For example consider what would happen with these example breakthroughs:

- Self-Improving AI (Recursive Self-Optimization): AI systems capable of autonomously improving their own algorithms, architectures, and learning processes, accelerating capability growth far beyond human-led development. With this advancement, accounting would see improvements like AI autonomously discovering and implementing new, more efficient auditing and reconciliation methods overnight, continuously optimizing tax strategies based on real-time regulatory changes, and rapidly eliminating inefficiencies in financial workflows-making human oversight and innovation redundant as the AI outpaces human learning and adaptation.

- AI-Driven AI Research: Advanced AI agents conducting research to invent new accounting models, compliance strategies, and financial analysis techniques. With this, accounting would see AI generating and testing thousands of new accounting standards or fraud detection algorithms daily, instantly deploying the most effective ones-removing the need for human-led standards boards or research committees.

- Quantum AI: Leveraging quantum computing to process and analyze massive, complex financial datasets at unprecedented speeds. In accounting, this would allow for real-time, global, continuous audits of all financial transactions, instantly detecting anomalies or compliance issues, and rendering human auditors and reconciliation teams obsolete.

- Multimodal and Multisensory AI: AI that can interpret and synthesize information from text, numbers, images, audio, and video. This means accounting AI could analyze financial statements, scanned receipts, voice memos, and video calls simultaneously, detecting fraud or errors invisible to humans and automating all forensic and investigative accounting. This one has already begun but in autonomous systems it takes on a whole different perspective on what it’s capable and the speed and scale.

- Advanced Sentiment and Behavioral Analysis: AI capable of interpreting emotional tone and behavioral cues from communications and video. In accounting, this would enable early detection of financial fraud or misstatements by analyzing the behavior of executives during earnings calls or internal meetings, eliminating the need for traditional forensic accountants.

- Specialized Hardware Accelerators: Custom AI chips optimized for accounting tasks. These would enable AI to process years of financial records, run complex simulations, and close books in seconds, making human speed and accuracy irrelevant in financial reporting and analysis.

- Serverless and Edge AI: AI deployed directly on financial systems and devices, enabling real-time, autonomous decision-making. Accounting functions like transaction categorization, fraud detection, and regulatory compliance would occur instantly at the point of data entry, removing the need for centralized human accountants.

- Automated Regulatory and Legal Reasoning: AI that can instantly interpret, update, and apply new accounting standards and regulations. This would allow accounting systems to automatically adjust ledgers and compliance practices the moment new rules are published, eliminating the lag time and manual labor associated with regulatory change.

- Massive-Scale Simulation and Scenario Analysis: AI capable of running millions of financial scenarios and stress tests in parallel. Companies could instantly optimize capital allocation, tax planning, and risk management strategies, making human strategic planners and analysts unnecessary.

- Automated Data Ecosystem Integration: AI that autonomously connects and harmonizes data from banks, tax authorities, suppliers, and clients. This would enable seamless, error-free data flows and reconciliation across all financial systems, removing the need for human data integration specialists.

- AI-Driven Governance and Audit: Fully autonomous, explainable AI systems that continuously audit themselves and provide transparent, regulator-ready justifications. This would result in instant, self-certifying financial statements and compliance reports, eliminating the traditional audit profession.

- AI Ecosystem Coordination: Networked AI agents coordinating financial activities across organizations and jurisdictions. This would allow for real-time, automated negotiation of intercompany transactions, global tax optimization, and regulatory compliance, making human accountants and financial managers redundant in cross-entity coordination.

And all of this is slightly ignoring what is happening with agent-based or agentic AI. The notion that these advanced AI system can communicate, collaborate, reason, negotiate and execute autonomously leads to solutions and scenarios barely comprehendible in terms of scale, speed and results.

The Transformed Landscape of Accounting

The evolution from AI-augmented to AI-autonomous accounting would represent one of the most dramatic professional transitions in modern history. What begins as a productivity enhancement tool ultimately reshapes the entire profession, with profound implications for education, employment, and professional identity in the field of accounting.

As this transformation unfolds, both the accounting profession and the broader society must grapple with fundamental questions about the changing nature of work, the role of human judgment in financial systems, and how to create sustainable career paths in a world where AI increasingly takes over traditionally human domains.

The Ultimate Thought Experiment: Accounting’s Existential Crossroads

Let’s pause to deeply consider the trajectory outlined above, confronting accounting’s existential crossroads. Picture the year 2045: AI has surpassed human capabilities in nearly every aspect of accounting. Millions of AI systems perform tasks previously requiring extensive human training and judgment—instantly, tirelessly, and perfectly. But rather than offer answers, I leave you with critical questions to guide our collective exploration:

1. The Feasibility of Exponential Displacement

- Assumption vs. Reality: The timeline assumes uninterrupted AI advancement, but what systemic barriers (e.g., regulatory pushback, societal resistance, or computational limits) could derail this trajectory?

- Human Adaptability: If productivity gains historically expanded accounting roles (e.g., spreadsheet adoption), why might AI-driven productivity differ? Could new niches emerge faster than old ones vanish?

2. Ethical and Accountability Frontiers

- Decision Ownership: When AI autonomously files taxes, audits financials, or optimizes strategies, who bears liability for errors—the developer, the user, or the AI itself?

- Bias and Transparency: How can accountants ensure AI systems uphold ethical standards if their decision-making processes are opaque?

3. Societal and Economic Ripples

- Employment Tsunami: If 92% of accounting roles vanish by 2045, what safeguards could mitigate mass unemployment? Universal basic income? Mandatory retraining?

- Concentration of Power: Will AI-driven accounting consolidate control among tech giants, or democratize access to financial expertise?

4. Redefining Professional Identity

- Value Beyond Numbers: If AI masters technical tasks, does the profession’s future lie in interpretation (e.g., contextualizing AI outputs) or human-centric roles (e.g., client trust-building)?

- Education Overhaul: Should accounting curricula prioritize AI literacy, ethics, and interdisciplinary skills over traditional technical training?

5. Existential Pathways

To take this further, explore three divergent scenarios. Which ones resonate with you as likely and why?

- Symbiosis: Humans and AI merge into hybrid roles (e.g., AI ethicists, algorithm auditors).

- Obsolescence: Accounting becomes a fully automated utility, like electricity.

- Reinvention: The field pivots to entirely new services (e.g., AI governance, meta-financial strategy).

Final Challenge to Readers

“If this trajectory is inevitable, what steps—today—would you take to future-proof the profession? If it’s not, what critical flaws in the thought experiment’s assumptions expose its fragility?”

This thought experiment aims not to forecast a definitive future but to prepare us to engage proactively and constructively with possibilities we cannot afford to ignore. I look forward to hearing your thoughts and over time I will be sharing my own.